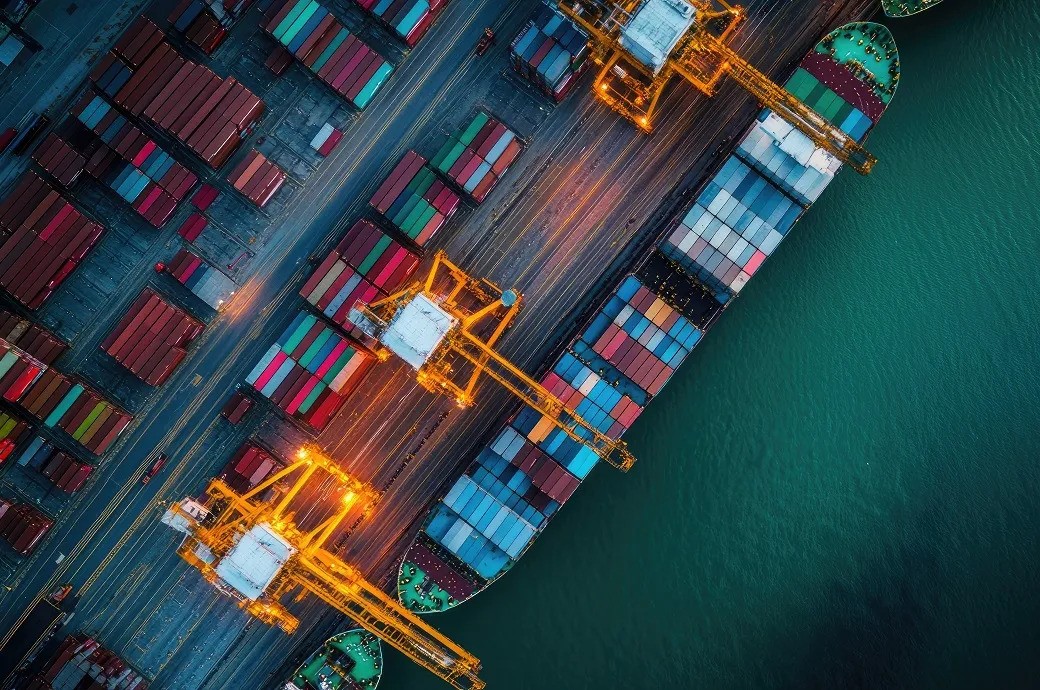

The ongoing dockworkers strike that began early Tuesday could soon ripple through the oil and gas sector, potentially causing serious disruptions if it drags on long enough, according to industry experts. Though the Department of Energy (DOE) quickly assured the public that the shutdown of 36 East and Gulf Coast ports would not immediately affect crude oil, gasoline, or other liquid fuel imports and exports, some industry voices are raising alarms about the broader economic impact.

The DOE’s statement pointed out that port operations tied to liquid fuel are handled by other workers and that “the strike will not have any immediate impact on fuel supplies or prices.” However, Phoenix Capital Group CEO Adam Ferrari offered a different perspective. “While you can say there might not be an ‘immediate’ impact, there is still the consideration of the overall economic hit the U.S. will take across all industries, including the oil and gas industry,” he explained.

Ferrari highlighted that East and Gulf Coast ports manage roughly half of all U.S. container imports, and if the strike escalates, it could wreak havoc across the entire supply chain. He further emphasized that loading and unloading natural gas products could be disturbed, potentially leading to shortages and price hikes down the line, especially for consumers.

Supply Chain Shocks: Domino Effect on Fuel Prices

Ferrari described the situation as a “domino effect,” warning that higher gas prices could trigger fluctuations in stock prices, create investor and market uncertainty, and prompt further government regulation within the sector. According to Ferrari, the supply chain is essential for the oil and gas industry, and any sustained disruption will eventually be felt across all related sectors.

Energy market analyst Phil Flynn, writing in his Phil Flynn Energy Report, echoed these concerns. He suggested that while oil tankers and LNG shipments might be shielded from the strike’s direct impact, the reduction in container ship movement could decrease oil demand.

“The possibility that factories may shut down because of the strike will also reduce demand for oil and could lead to a larger U.S. recession, further hampering demand,” Flynn noted.

Union Demands Could Prolong Strike

The strike, which marks the first major action by the International Longshoremen’s Association (ILA) since 1977, follows the expiration of a six-year contract with the U.S. Maritime Alliance. Negotiations have stalled as the union pushes for wage increases, compensation adjustments, and safeguards against automation at ports. With talks deadlocked, President Biden faces pressure to intervene. However, he has expressed reluctance to invoke the Taft-Hartley Act, which would force operations to resume during negotiations.

A range of business organizations, including the National Association of Manufacturers and the U.S. Chamber of Commerce, have urged the president to act. They argue that the economic consequences of a prolonged strike warrant immediate intervention.

Economic Toll: Billions at Stake Each Day

An analysis from JPMorgan estimated that a prolonged port strike could cost the U.S. economy between $3.8 billion and $4.5 billion per day. Although Anderson Economic Group’s projections suggest a lower figure—$2.1 billion in the strike’s first week—AEG’s CEO Patrick Anderson acknowledged that the ultimate cost would hinge on the strike’s duration and whether the administration steps in to mediate.

As the strike drags on, the oil and gas industry, along with many other sectors, is watching closely, wary of the potentially widespread and costly effects on the economy.