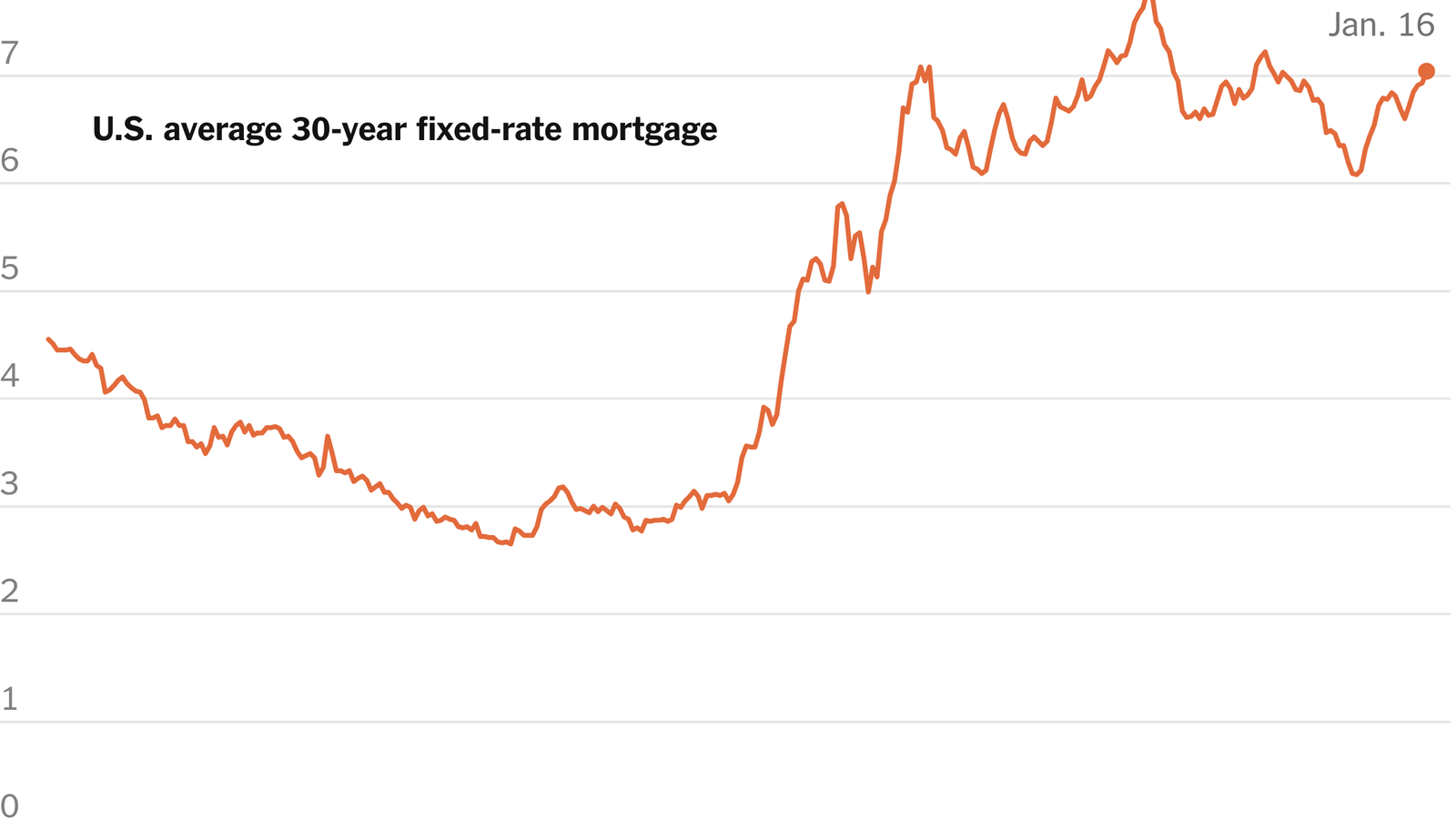

Mortgage rates are continuing their upward march, marking a third straight week of increases and inching closer once again to the dreaded 7% mark.

According to Freddie Mac’s latest Primary Mortgage Market Survey released Thursday, the average rate on the 30-year fixed mortgage climbed to 6.89%, up from 6.86% the week before. This puts the average at its highest point since February 6th ,when it last touched 6.89%.

For comparison, this time last year, the 30-year rate stood at a slightly steeper 7.03%.

Meanwhile, the 15-year fixed mortgage rate also crept higher, rising to 6.03% from 6.01% a week earlier. A year ago, the same loan carried a 6.36% average.

Buyers Still Face a Crunch—And It’s Not Just Rates

Adding pressure to already-strained homebuyers, home prices in the U.S. have surged for a fifth straight month. With affordability hitting its lowest levels in decades, buyers are increasingly competing for limited listings.

That’s why Sam Khater, chief economist at Freddie Mac, is urging buyers to be strategic: “Aspiring buyers should remember to shop around for the best mortgage rate, as they can potentially save thousands of dollars by getting multiple quotes.”

Contract Signings Slide as Rates Stall Buyer Confidence

In another sign that high borrowing costs are chilling the market, the National Association of Realtors (NAR) reported Thursday that its Pending Home Sales Index dropped sharply last month. The index, which tracks signed contracts for home purchases, fell by 6.3% to 71.3, a steeper drop than the 1% decline economists had expected.

Compared to the same period last year, pending home sales are now down 2.5%.

“At this critical stage of the housing market, it is all about mortgage rates,” said Lawrence Yun, chief economist at the NAR.

“Despite an increase in housing inventory, we are not seeing higher home sales. Lower mortgage rates are essential to bring home buyers back into the housing market.”

The Bigger Picture: Inventory Isn’t Enough Without Affordability

A recent joint report by the National Association of Realtors and Realtor.com reinforces what many already feel, the real estate landscape is becoming a battlefield, especially for middle-income Americans. The data shows that although many households could afford a home, there simply aren’t enough listings to meet the demand.

So even as more homes hit the market, the affordability crisis remains center stage, driven largely by these persistently high mortgage rates.