Mortgage rates are easing. Buyers are watching. And a handful of U.S. cities could soon feel a serious surge in home shopping activity.

With borrowing costs projected to slide closer to 6% over the next year, fresh data suggests pent up demand is ready to break loose in several mid sized and fast growing metros where affordability and inventory are finally lining up.

Rates Drift Lower as Buyers Regain Leverage

Industry experts say the timing is shifting in buyers’ favor. As one real estate leader recently put it, “Now is ‘as good a time as any’ to buy real estate.”

That view reflects a broader shift unfolding across the housing market. As rates pull back from recent highs, monthly payments ease, and thousands of households suddenly qualify for homes that were just out of reach months ago.

How the Markets Were Selected

The National Association of Realtors examined 10 major indicators to identify where buyer demand could heat up fastest. The analysis focused on how lower mortgage rates improve purchasing power, how closely home prices align with local incomes, population migration, employment growth, and housing inventory trends.

The objective was to determine where “home sales will likely be liveliest in the coming year.”

Each metro on the list has more than 250,000 residents, outperforms the national average on at least five indicators, and offers clear opportunities for buyers and real estate professionals.

Charleston, South Carolina

Charleston is beginning to see affordability loosen. Inventory is expanding in the $200,000 to $350,000 price range, and more than 20,000 additional households would qualify for a median priced home if rates fall to 6%.

Millennials account for 36% of local households, while job growth and incomes remain strong.

According to the report, “Charleston has a large pool of renters who are just at the edge of affordability.” It added, “A shift from 7% to 6% significantly expands the number of local households who qualify for the median home.”

Charlotte, North Carolina

Charlotte could see one of the most dramatic jumps in buyer activity. More than 52,000 households would newly qualify for a median priced home at a 6% mortgage rate.

Strong migration, rising incomes, steady job growth, and a high concentration of millennial buyers continue to fuel demand.

The outlook was summed up simply: “Charlotte’s winning formula in 2026 is simple: young buyers, strong jobs, and more listings where people need them.”

Columbus, Ohio

Columbus continues to exceed expectations among Midwestern markets. More than 41,000 additional households would qualify at lower rates, and millennials make up 37.5% of the local population.

Income growth is outpacing the national average, while new investments are driving job creation.

The association noted, “Columbus continues to outperform expectations as one of the Midwest’s most resilient and stable housing markets. Income growth remains stronger than the U.S. average, and investments — including logistics expansions — are bringing high-quality jobs that support long-term housing demand.”

Indianapolis, Indiana

Indianapolis earned recognition as one of the “most balanced and opportunity-rich markets heading into 2026.”

At a 6% mortgage rate, more than 42,700 additional households would gain buying power. Strong millennial presence, solid job growth, and home prices that align more closely with local incomes strengthen the city’s outlook.

Jacksonville, Florida

Jacksonville stands out for improving conditions on multiple fronts.

As the report explained, “Jacksonville is one of the Florida markets where both affordability and inventory are improving at the same time.”

Nearly 39,700 additional households would qualify for a median priced home if rates ease, supported by income growth and steady inbound migration.

Minneapolis–St. Paul, Minnesota

The Twin Cities could be among the biggest beneficiaries of falling rates. More than 81,000 households would newly qualify at a 6% mortgage rate.

Homes priced between $250,000 and $450,000 are returning to the market, job growth remains strong, and millennial households are plentiful.

Researchers summed it up clearly, saying “Minneapolis is one of the nation’s most responsive markets to lower rates — and 2026 will show it.”

Raleigh, North Carolina

Raleigh continues to deliver strong fundamentals. Nearly 27,000 households would gain purchasing power with lower mortgage rates.

The area benefits from rising incomes, steady job growth, a large millennial population, and a stronger match between home prices and earnings.

The report stated, “Raleigh’s combination of fast-growing incomes and better-aligned inventory makes it one of the clearest opportunity markets of 2026.”

Richmond, Virginia

Often overlooked, Richmond is quietly positioning itself for a strong year ahead.

More than 25,500 additional households would qualify at lower rates. The city shows steady job gains, fewer price cuts than the national average, strong millennial representation, and home prices that better match incomes.

The association described Richmond as one of the “most quietly powerful opportunity markets in 2026,” adding, “Richmond’s strength lies in its stability — and in 2026, that stability becomes opportunity.”

Salt Lake City, Utah

Salt Lake City continues to appeal to younger buyers. About 25,000 additional households could afford a median priced home at a 6% mortgage rate.

Strong income growth, job gains, and improving inventory are reshaping the market. Listings aligned with local incomes are rising rapidly.

According to the report, “Salt Lake City’s youthful demographics and improving inventory make it one of the biggest beneficiaries of lower rates in 2026.” It also noted, “Listings aligned with incomes surged 20.7% year-over-year, making it one of the biggest affordability rebound markets.”

Spokane, Washington

Spokane stands out among Western markets.

As researchers observed, “Spokane is one of the few Western metros where both affordability and inventory are trending in the right direction.”

More than 9,500 households would newly qualify at lower rates, supported by income growth, a strong millennial presence, and fewer price cuts than the national average.

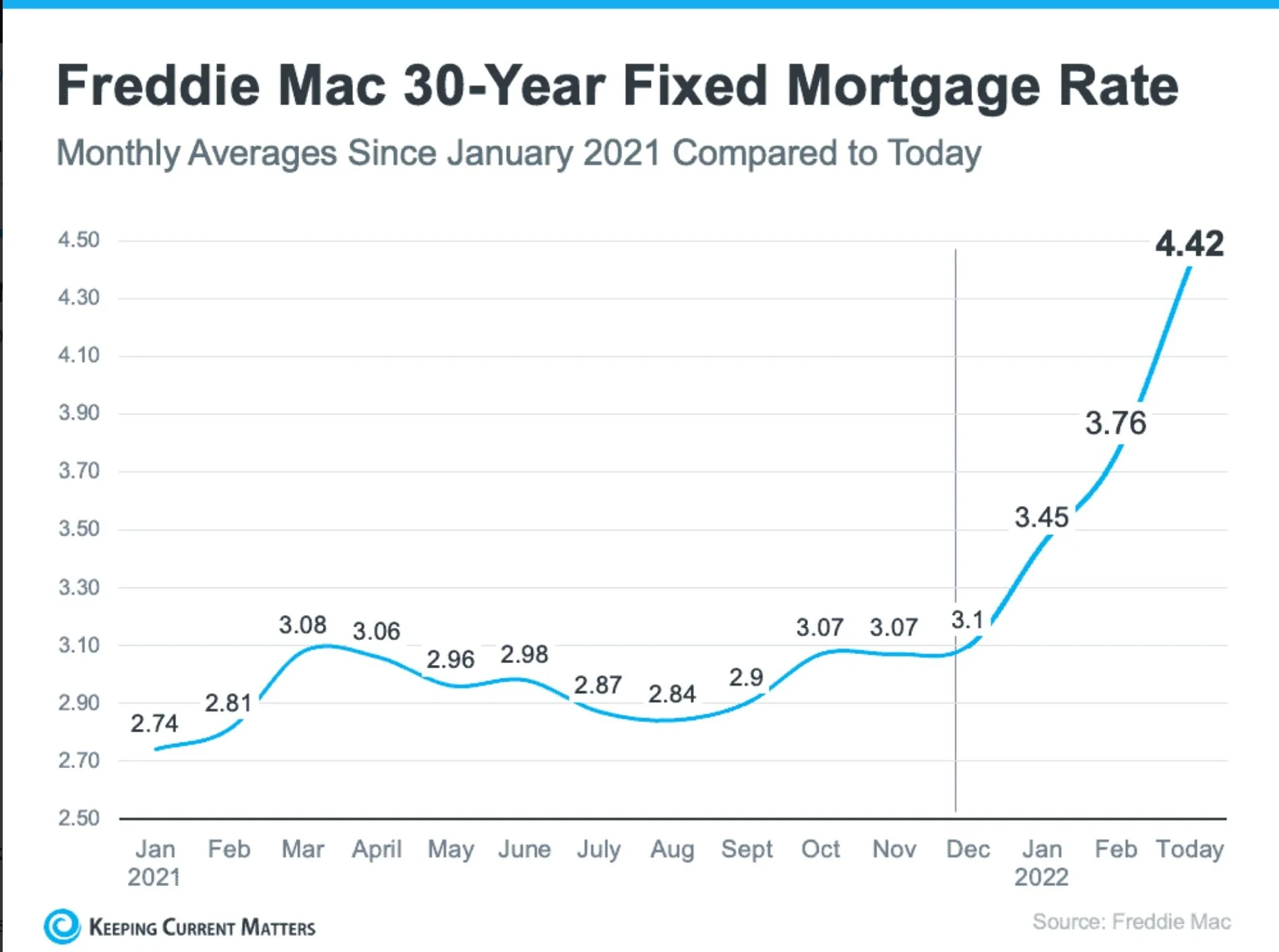

Where Mortgage Rates Stand Now

Mortgage rates edged higher last week as markets reacted to the Federal Reserve’s third straight interest rate cut amid uncertainty around inflation and labor conditions.

The average 30 year fixed mortgage rate climbed to 6.22% for the week ending December 11, up slightly from 6.19% the week before. One year earlier, rates averaged 6.60%.

If rates continue their gradual decline, these markets may soon see buyers act quickly before competition intensifies.