The Federal Reserve recently cut its borrowing rate by half a percent, offering a glimmer of hope for potential homeowners. Lower mortgage rates suggest a cooling of inflation, possibly making homeownership more affordable. Despite these shifts, housing remains a top issue in the upcoming presidential election—a rarity in American politics.

Housing: A Local Issue with Federal Impacts

In local and state jurisdictions, housing is largely managed at those levels, with limited federal involvement. Although the government influences low-income housing and lending standards, broader market conditions remain out of its reach. When federal intervention occurs, it often has unintended consequences.

The 2008 housing crash, fueled by federal policies and subprime lending, serves as a stark reminder of the potential fallout. Back then, plummeting prices hit places like California particularly hard. More recently, COVID-era policies contributed to soaring prices as demand surged.

Supply and Demand: The Real Driver of Prices

Today, housing prices are a matter of supply and demand. Environmental regulations and zoning laws restrict building, limiting supply and driving up costs. Yet, rather than addressing these factors, federal authorities are pursuing actions that may only deepen the crisis.

Consider the recent antitrust lawsuit against RealPage, a software firm accused of price-fixing through its algorithmic pricing software. As CBS News reported, RealPage allegedly “engaged in a price-fixing scheme by sharing nonpublic, sensitive information, which RealPage’s algorithmic pricing software used to generate pricing recommendations.”

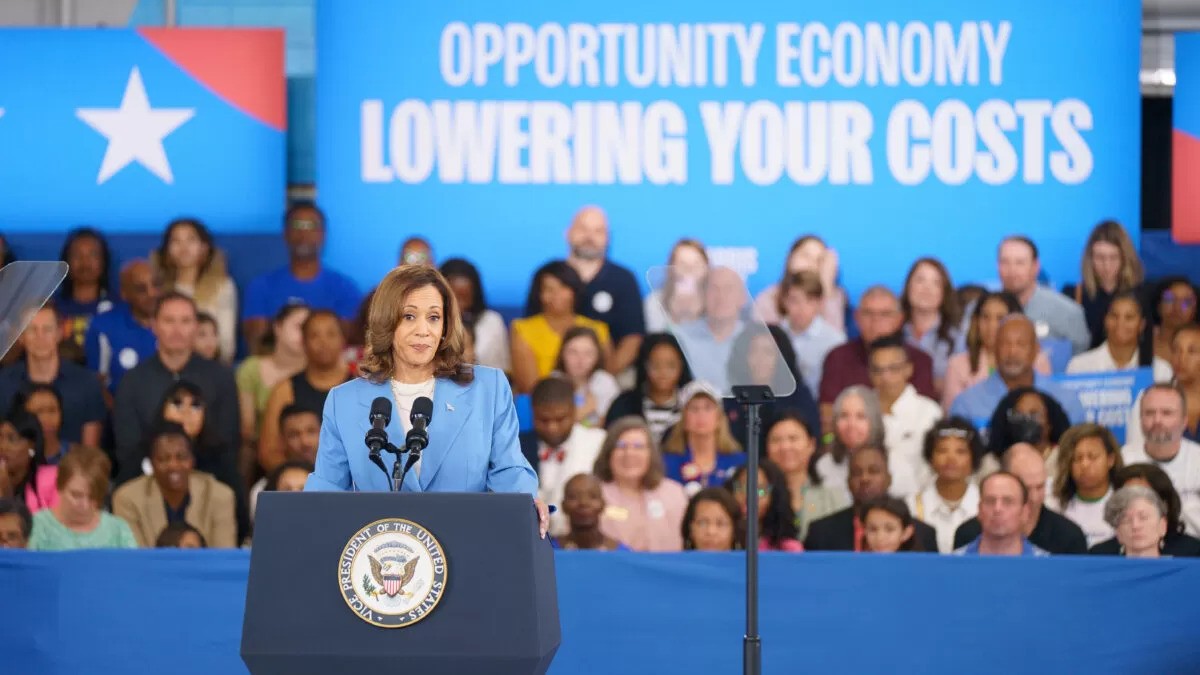

Harris’ Ambitious Plans: Solutions or New Problems?

Kamala Harris has proposed an ambitious plan to tackle housing costs, including tax incentives for homebuilders and a $25,000 down-payment assistance program for first-time buyers. While she calls for cuts to red tape and promotes more construction, her proposals could lead to higher housing prices. When subsidies make money available, sellers often adjust their prices accordingly, a phenomenon we may see here.

Additionally, Harris’ plan to curb the influence of large landlords and rental data firms reflects a strategy of targeting corporations.

She has vowed to “stop rent-setting data firms from price fixing to raise rents to double digits”

and aims to curb Wall Street’s role in bulk home purchases.

Scapegoating Technology and San Francisco’s AI Rental Ban

In some ways, her proposal mirrors recent San Francisco legislation that seeks to ban AI from influencing rental rates. The American Consumer Institute critiques such moves, stating, “The rise in rent prices is driven by complex market factors such as inflation, interest rates and supply-demand dynamics — not AI algorithms. Scapegoating technology for broader market issues is misguided.”

In San Francisco, stringent tenant laws have led to a 15 percent reduction in rental stock, creating a market where landlords hesitate to rent out properties. With vacancy rates high, the housing supply issue remains unresolved.

GOP Response: Trump’s Shifting Housing Stance

On the GOP side, Donald Trump’s stance has varied. While he’s recently advocated for fewer zoning restrictions, he’s also endorsed measures like barring illegal immigrants from obtaining mortgages.

Real Solutions Are Needed Beyond Political Rhetoric

Both parties recognize the housing crisis, but their solutions could worsen existing problems. Real solutions should focus on underlying issues, not just scapegoats or quick fixes.